Lowest Ever.

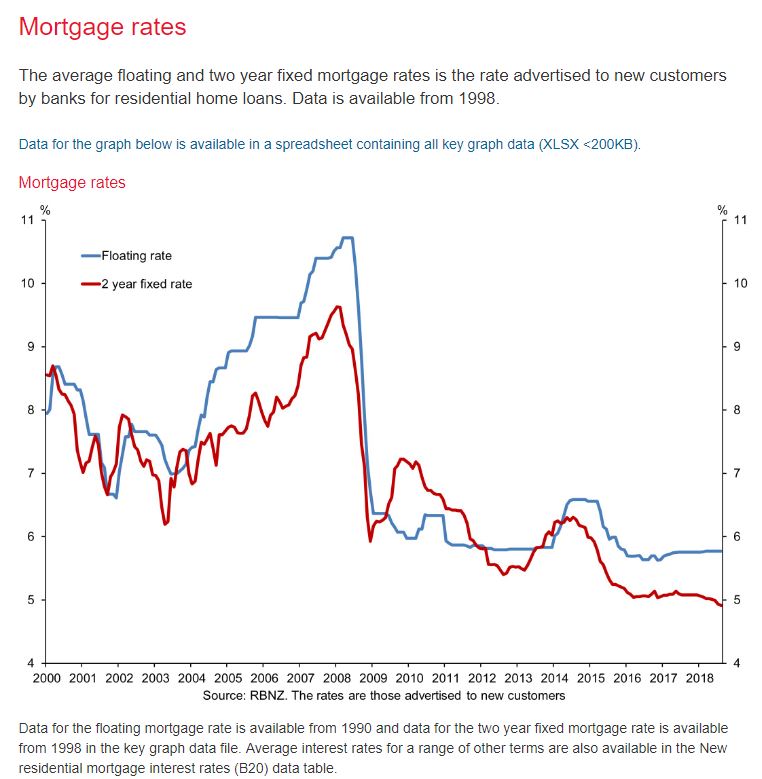

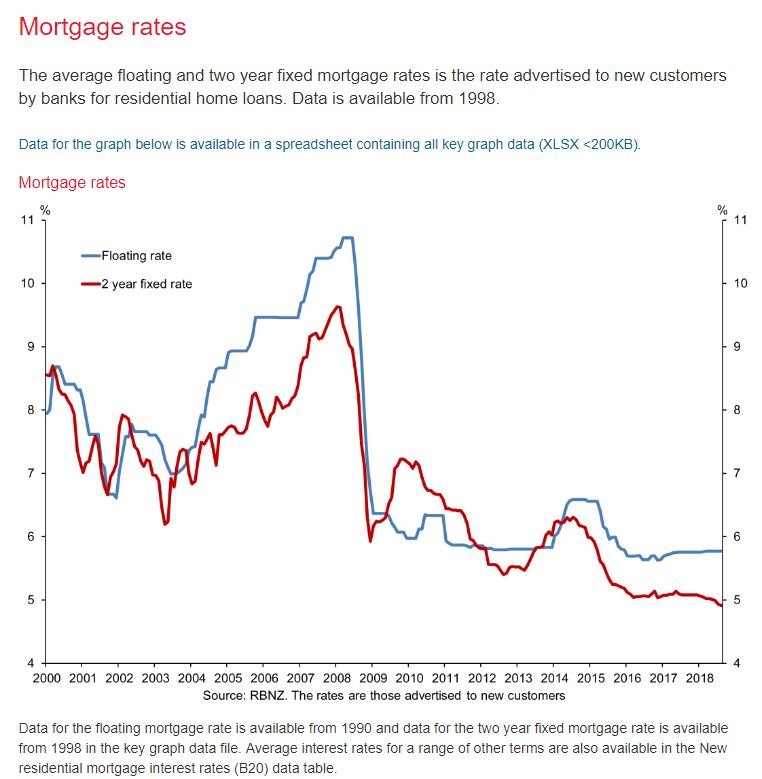

Way back in June and July 2015 fixed rates hit 60-year lows as floating rates and the OCR were also tumbling. The rates were all around the mid 4% range and we thought at the time it would be a long time before we’d see rates that low again.

Back then I was saying that the RBNZ had moved prematurely upwards, through 2014 – they had become myopic about Auckland housing and had moved the OCR up at great expense to the regions. That not only failed to curb house price rises in Auckland, it hurt the whole country by pushing up interest costs, as well as poured gasoline on the hot kiwi dollar (we nearly hit parity with the Aussie in August 2015) and they ended up eating some crow and dropping back just as quickly.

This means war!

ANZ, Westpac and ASB this week announced record low 1 year fixed rate specials of 3.95%. BNZ has gone in even stronger and offered its lowest ever two-year fixed rate of 3.99%. This is going to trigger some comment and article writing and lots of well-meaning advice.

Is this mortgage price war good for first home buyers? Not really. And it’s not aimed at them anyway – to get these specials you must have 20% equity – they are a land grab or a retention tool to win and/or keep customers. I also wonder about the need to make some nice headlines rather than ones like this, and this, and this, and this.

Besides, while it will be cheaper to pay a mortgage at 3.95%, it won’t help you get one. When approving mortgages the banks use a test rate that checks you can service the loan even if rates go up. So while you can probably afford to pay a mortgage at 4%, the banks will determine whether to approve you based on a much higher rate. It varies, but many are close to 8%.

A spring in your step

The other thing is, in spring the market usually heats up a bit. Some vendors believe their property is prettier now, and will wait until after winter to list, while others are doing the whole ‘before christmas’ thing. So with a little more volume, prices can move around, usually up (when prices fall so does volume). A mortgage price war will amplify this uptick, so if property prices were starting to stagnate, this mortgage war could trigger new price growth.

Already fixed?

So am I. Breaking costs will be driven up by reduced rates, so by the time you hear about a cheap rate, breaking the one you have already costs more. If you are only a couple of months out from the end of a fixed term, then you can ask your bank to book or lock in a current rate. If like me you have to wait until next year, well let’s see next year. At least petrol is coming down again.

Structure is important

When I did my own, and most customer’s loans, I split the borrowed amount into multiple tranches or accounts that can be fixed for different terms. It means that I have the certainty of a long rate, but also not waiting too long if rates drop. I usually keep a bit on floating too, just in case a pay rise or a small windfall comes along that can be chucked in.

Advice matters

Half the time I’m adding value just by making sense of all the noisy news, and helping clients decide what’s best for them in light of where they are at, and what they want to do next. Get in touch if you want to have a chat.