Recently a kiwi living in Australia has sued ANZ Bank for selling him a life policy that would never have paid out had he actually died. His policy excludes payment to people who “are not an Australian Citizen or Permanent Resident of Australia” at the date of death. Due to the ‘Special Category Visa’, which is unique to New Zealanders living in Australia, New Zealanders cannot become either of these things.

Recently a kiwi living in Australia has sued ANZ Bank for selling him a life policy that would never have paid out had he actually died. His policy excludes payment to people who “are not an Australian Citizen or Permanent Resident of Australia” at the date of death. Due to the ‘Special Category Visa’, which is unique to New Zealanders living in Australia, New Zealanders cannot become either of these things.

This matter has brought the use of policy exclusions into the spotlight on both sides of the Tasman. All policies have exclusions – most, for example, will not cover you if you die as a result of ‘intentional self-inflicted injuries’ during the first 13 months of the policy.

But some go further. Some policies have additional exclusions that you should make sure you avoid. At MoneyTree we make it our business to do our own research, and we also use independent specialist research to support our product recommendations.

We think that insurance is meant to be about certainty and peace of mind. Unnecessary and unfair exclusions should not be part of the picture – particularly if they are not required by the majority of insurance providers.

Some insurers add broad exclusions to compensate for with asking fewer questions in a “simple” or “quick” application form. Some need to make sure they are protected from customers who apply unsupervised over the internet.

Independent research by Quality Product Research, and our own side-by-side comparisons have shown that adviser based policies have wider cover, more comprehensive benefits and fewer exclusions. We can deliver better outcomes for people who need to claim. But don’t assume that means adviser policies cost more. Consumer magazine did a detailed comparison and found that every single bank life cover offer could be bettered by a product sold by an Adviser.

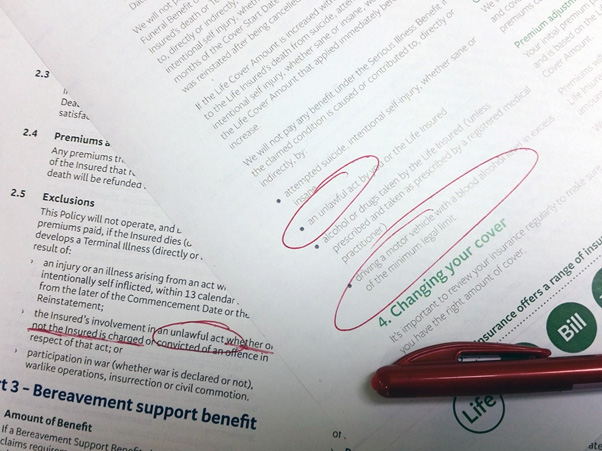

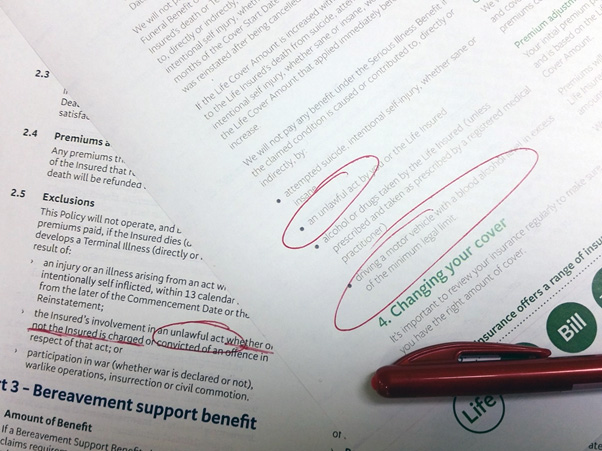

The top 3 exclusions we want to avoid:

- Unlawful act. Some policies exclude death as a result of “involvement in an unlawful act”. One even adds “whether or not the insured is charged or convicted…”

This exclusion could mean if you are alleged to have been involved in a very minor offence such as speeding before your car crashed, or if the Warrant of Fitness was expired, your life claim could be denied. Remember, whether or not you are charged….

- No payment if you are not in New Zealand when you are injured or killed.

- No cover if you are living and/or working outside New Zealand.

The last two are particularly important if you like to travel, are planning an OE or you plan to work outside New Zealand at all, ever.

Bonus exclusion: I recently came across a policy that excludes death as a result of “engaging in a work or lifestyle activity that involves explosives, weapons, heights, depths….”. So if you enjoy a spot of hunting or diving it would pay to make sure you’re covered for wherever you go and whatever you do.

If you or someone you care about purchased insurance from a bank, letterbox, ipad or a phone number on the back of a bus then it really does need to be checked by a qualified and experienced adviser.